how to file taxes if you're a nanny

How to file taxes as a nanny without W2. Ad Looking for tax for nanny.

More Parents May Owe Nanny Tax This Year Due To Covid 19 Miller Kaplan

Report Inappropriate Content.

. Dont Know How To Start Filing Your Taxes. That means you file taxes the same way as any other employed person. Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages.

Content updated daily for tax for nanny. Connect With An Expert For Unlimited Advice. Employers must pay employment taxes and manage other payroll responsibilities.

Complete year-end tax forms. A household employer will need to obtain an employer identification number withhold taxes. The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount.

Ad The fast easy and 100 accurate way to file taxes online. Connect With An Expert For Unlimited Advice. If youre a nanny who cares for children in your employers home youre likely an employee.

You will need to file a yearly 1040 tax return and pay federal income tax. Taxes Paid Filed - 100 Guarantee. Dont Know How To Start Filing Your Taxes.

Ad File 1040ez Free today for a faster refund. In addition you will file a Schedule C form which will calculate your net income or loss for your business. Attach Schedule C or C-E.

If you were paid more than 1800 by one employer you should receive a W-2 as a Household Employee. Your employer is required to give you a form W2 by January 31st. Some other services can even.

Revealing and Filing Taxes. The 2022 nanny tax threshold is 2400 which means if a. You as an employer just enter the hours and everything gets calculated for you but it doesnt make payments on your behalf or file tax returns.

You must provide your nanny with a Form W-2 by the end of January each year so they. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. I am a nanny how do I pay my taxes.

To file quarterly utilize this structure to estimate representative federal annual tax manager and worker Social Security. You should send 1040 estimated payments to the IRS four times per year. Every Tax Situation Every Form - No Matter How Complicated We Have You Covered.

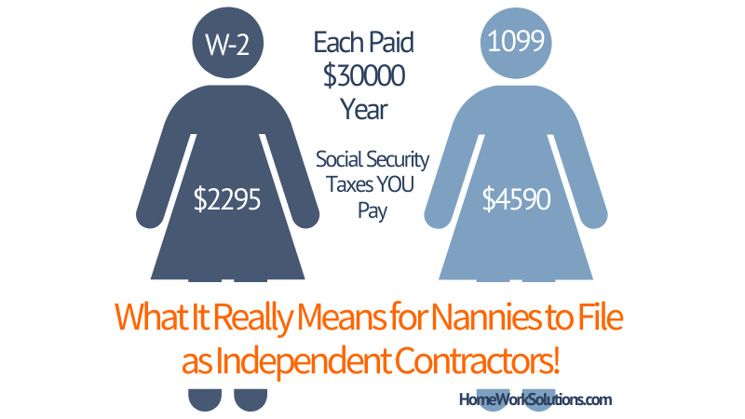

File Copy A of Form W-2 and Form W-3 with the Social Security Administration by. However half of this tax will serve as. In addition to income taxes you will also be charged Self Employment Tax Social Security and Medicare at roughly a 15 rate.

Ad Receive you refund via direct deposit. Ad HomePay Can Handle Your Nanny Payroll And Nanny Tax Obligations. This form will show your wages and any taxes withheld.

Ad Easy To Run Payroll Get Set Up Running in Minutes. You will use this form to file your. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

Nanny Household Employment Tax Who Owes It Taxact

How Nannies Should Report Extra Babysitting Income Nanny Tax Income Tax Help

Nanny Tax Pitfalls And Need To Knows For Your Taxes

Babysitting Taxes Usa What You Need To Know

Caregivers Here S How Taxes And Payroll Work Care Com Homepay Nanny Tax Nanny Nanny Interview Questions

Nanny Payroll Part 3 Unemployment Taxes

Do I Need To Pay Taxes For My Nanny

Do You Have A Nanny In Your Home The Tax Law Imposes Employment Tax Responsibilities If A Household Worker S Wages Is More Than 2100 In 2019 If A Household W

How Does A Nanny File Taxes As An Independent Contractor

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

Nanny Taxes How To Pay Taxes For A Household Employee

Nanny Tax Do I Have To Pay It Credit Karma Tax

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

2015 Tax Changes Tax Guide Nanny Nanny Tax

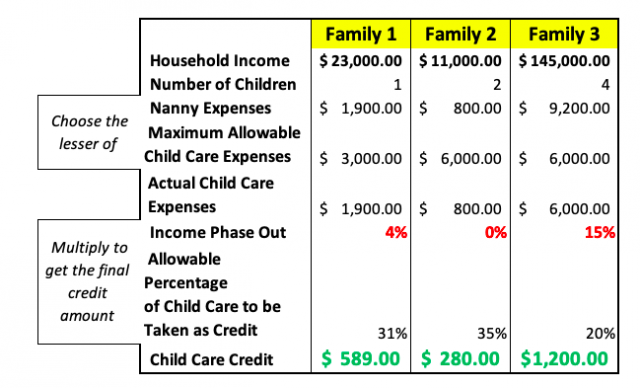

Can I Deduct Nanny Expenses On My Tax Return Taxhub

7 Steps For Filing Taxes As A Nanny Or Caregiver Care Com Homepay

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Hiring A Nanny Tips On Handling Taxes And Other Costs Mybanktracker